My Twitter timeline has been blowing up with news about Greece's decision to turn down a referendum that would accept debt relief coupled with severe austerity measures. I could find article after article after article explaining why voting "no" on this referendum was a terrible idea. However, since 61% of a country can rarely agree on their favourite kind of ice cream, let alone something with this level of economic magnitude, I was curious to learn what the "other side" of the story was.

So I posted the following to Twitter:

"Lots of sources saying horrible things about #GreeceReferendum outcome. Having trouble finding some that rationalize the "Oxi" vote. Links?"

Several people responded with lots of awesome resources. Having read all of them (this took awhile :)), here's my best stab at a summary:

- Many cite the Euro as the major cause. The claim is that the Euro as a currency doesn’t really work across a set of countries with as diverse economic situations as Europe. There are some standard ways to respond to economic collapse—for example, devaluing the currency to make exports/tourism cheaper—but Euro zone countries like Greece cannot do this because that would also devalue the currency in wealthier nations, such as Germany. Helpful 3 minute video explanation /HT @Paulmicha This best cases for "no" and "yes" piece /HT @rsbrown argues the same. Ending Greece’s Bleeding /HT @Paulmicha goes so far as to suggest that a "Grexit" (Greece leaving the Euro zone) is actually the best of all the bad options now.

- And while North America has always had the concept of "have"/"have not" states/provinces, with the better off subsidizing the less so, Canada and the United States are each their own countries ("Americans first, Oregonians second"). The Euro zone, in contrast, is comprised of individual countries, with a strong sense of nationalism ("Germans first, Europeans second"). See Seven Greek Myths /HT @tvnweb for an argument that it doesn't need to be this way.

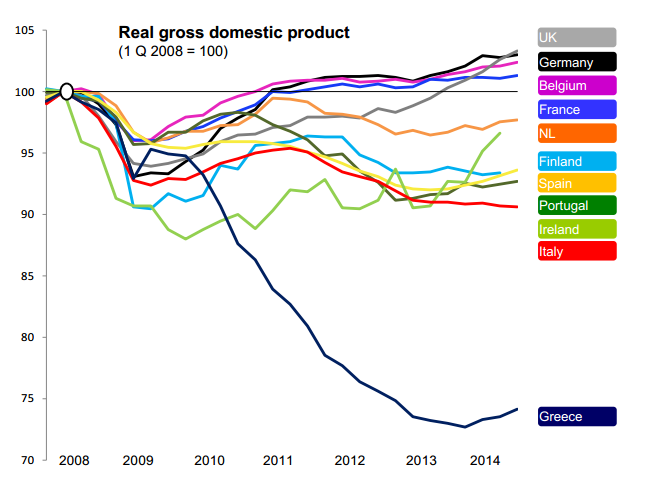

- The Greek government already took a bailout in 2010 which came with some stiff austerity conditions in terms of cutting salaries, jobs, and pensions. And unfortunately, this did not have the desired effect; GDP plummeted, unemployment skyrocketed. So more of the same medicine that is viewed by many to have caused the economic crisis in the first place did not seem sensible. interfluidity: Greece /HT Kazanir gets way into this, including this absolutely horrifying graph:

Also for those who like a shorter read, this is also played out in dramatic fashion in this hilarious reddit comment /HT @chx

- This new deal imposed even harsher restrictions which even the IMF itself says won't ultimately work out. /HT @chx

- Additionally, most of the money loaned to "Greece" never actually went there. It went instead to bolster the banks (including German and French banks) that gave Greece the bad loans. See How Europe played Greece /HT @steveparks

- There was also speculation among many that the proposal put forward "troika" (European Commission, European Central Bank (ECB), and International Monetary Fund (IMF)) was actually a thinly-veiled attempt to overthrow the democratically elected, far-left "Syriza" party that has been in power in Greece since January. A "yes" vote (in support of the troika's deal) would've spelled doom for the government's stated anti-austerity platform, and shown alignment with the big banks. How I would vote in the Greek referendum /HT @rohan_p spells out this dilemma. It's the Politics, Stupid! /HT @chx echoes this speculation.

- Several articles also express suspicion that those protesting on the "yes" side seemed a little too uniform, and a little too cashmere-covered (smacking of political/economic elite, oligarchs, and their brethren), versus the "no" side being more reminiscent of a true grassroots movement. The "yes" side strongly pushed a fear/apocalypse agenda, which was viewed cynically as serving the interests of the big banks and rest of Europe, versus Greeks themselves (in particular, impoverishing the elderly even further was seen by many as impossible to bear). Human Misery vs. Profits: What’s Happening in Greece /HT @dead_lugosi and did the just Euro die at 4pm? /HT @chx go into this discrepancy.

- Others bring up the history of WWI and WWII and point out the hypocrisy in that Germany, France, UK, and other nations were in the same boat as Greece and had their debt restructured, rather than facing the severe austerity measures Greece is faced with today. There are similarities drawn between the economic conditions of the early 1900s with that of the post-2008 financial crisis that argue for a similar EU-wide look at debt relief. See Germany has never repaid its debts /HT @boblucore

TL;DR Greece has "been there, done that" with very large sums of money with very large strings attached, and they've only seen things get worse for their country (and that large sum of money largely flowing out of Greece and into other European economies). The Euro doesn't provide enough flexibility for countries in Greece's predicament to do textbook recovery measures, making already bad economic situations worse. The deal proposed by the creditors was seen by some as a way to force power out of Greeks' hands and into banks' and other European countries' hands, which particularly didn't play well in the birthplace of democracy. There's also a hope that a "no" vote will provide Greece's elected government with a stronger negotiating position with the banks (though this definitely remains to be seen; the troika has much more incentive to make an example of Greece than work with them at this point, or they could see this pattern spread throughout the EU).

The More You Know™ Thanks so much to everyone who responded! Hope this summary is helpful, and also that I didn't screw it up too badly. :)

Comments

one small thing

Just at the start you said "Greece's decision to turn down a referendum".

- They turned down an offer from creditors with further cuts and austerity measures.**

- Greece held a referendum, which is a public vote on a particular policy or constitution change.

The appointed Eurogroup finance ministers certainly don't like that, since they can't turn to their electorate for backup. Politicians often have to make unpopular choices to get things done, so going to popular vote is seen as a betrayal of political dealing/negotiation. And basically, Europe leadership tends to ignore referenda anyway.

Eurogroup ministers probably saw this as a "populist game" (Juncker, EC President*), but then again, it's a populist party, and Syriza proved it's point. They are acting on the mandate from their people.

Which is what very few European leaders have been willing to do. And what the technocrats in Europe don't have to do.

* "Selfishness, tactical, even populist games got the upper hand", J P Juncker, http://mobile.reuters.com/article/topNews/idUSKCN0P91B120150629?irpc=932

(** Example: an increase on VAT on the islands to 23%, where it's about 7% in neighbouring Turkish islands with mainly German-owned hotels, was seen to threaten the vital tourist economy there.)

Robert Reich's take on the situation

You can find his comments from today at https://www.facebook.com/RBReich/photos/a.404595876219681.103599.1424740... and it's pretty much the same thing. Greece did the right thing, and even though it's not ideal, decoupling form the Euro would provide relief.